Fair

US stock and ETF management corporate actions, from tick-by-tick to daily resolutions.

US stock and ETF management corporate actions, from tick-by-tick to daily resolutions.

U.S. stock options with minute-by-minute resolution and realistic portfolio models.

US Cash Indexes from ticks to daily resolution bars for NDX, SPX and VIX.

U.S. index options have resolutions from minutes to daily and use portfolio models.

The U.S. futures market offers 70 of the most liquid contracts with daily settlement prices.

Futures options markets offer the 70 most liquid contracts at minute to daily resolutions.

Interbank and market maker brokerage spreads with realistic cash book and margin loans.

Provide international traders with derivative CFD assets from leading brokers with realistic spreads.

Thousands of cryptocurrency pairs from six exchanges, modeled on cash and margin accounts.

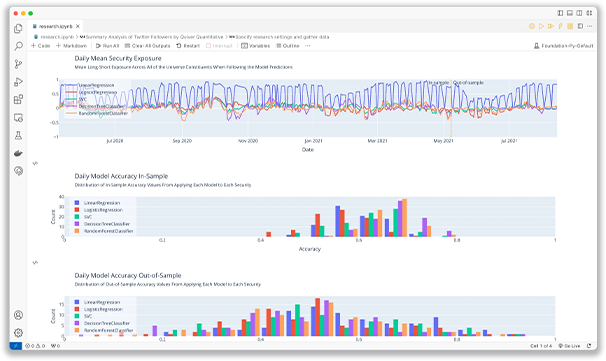

Our cloud-based research terminal comes with terabytes of

financial, fundamental and alternative data, preformatted and

ready to use.

Alternative data is linked to the underlying securities and

tagged with FIGI, CUSIP and ISIN to facilitate strategy

development.

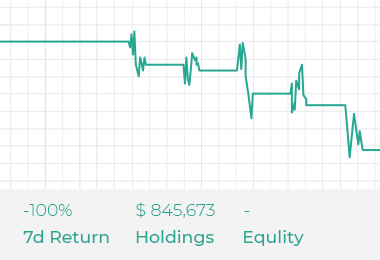

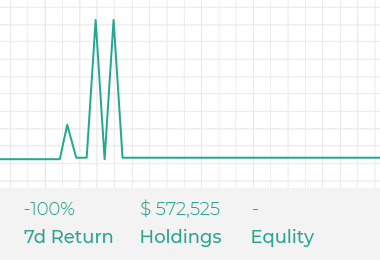

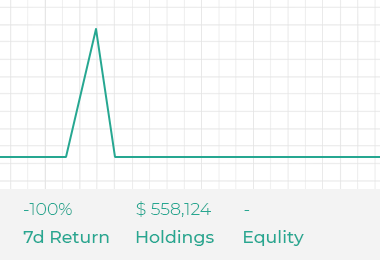

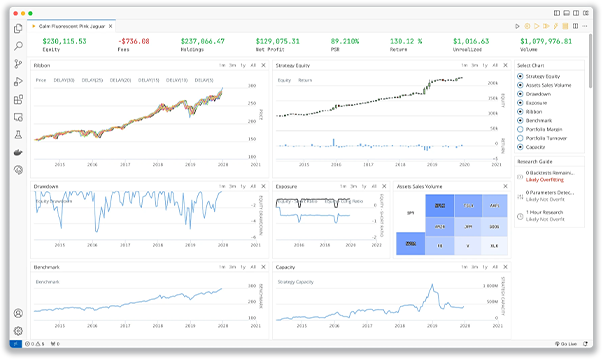

Go from research to point-in-time, fee-, slippage-, and

spread-adjusted backtesting on a lightning-fast cloud core with

minimal to no code changes. Run multi-asset backtests on

portfolios consisting of thousands of securities using realistic

margin models.

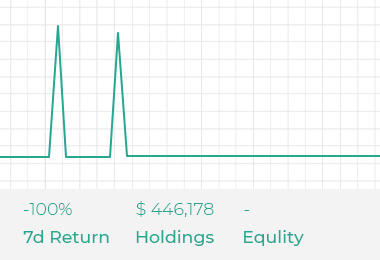

Import custom and alternative data related to the underlying

securities to realistically model live trading portfolios and

avoid common pitfalls like lookahead bias.

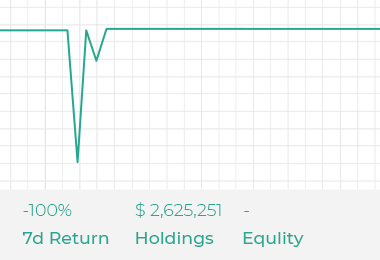

Our technology has been unit- and regression-tested thousands of

times and backtested over 15,000 times per day on Nuvonex.

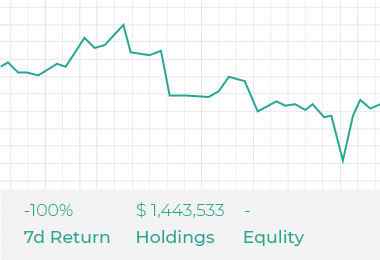

Jump-start your algorithm development with a selection of classic live strategies written by Nuvonex, as well as highlights from the community.